Commercial Property Investment in Gurgaon

Gurgaon has become one of India’s most active Commercial Investment in Gurgaon. The city attracts global companies, startups, and service firms across sectors. Office hubs, retail districts, and business parks continue to expand. Investors see strong demand for leased spaces, modern infrastructure, and long term growth potential. Commercial property in Gurgaon here is no longer limited to a few corridors. New micro markets are developing every year. This creates both opportunity and risk. Success depends on research, patience, and strategic decision making.

Understanding the Commercial Real Estate Landscape of Gurgaon

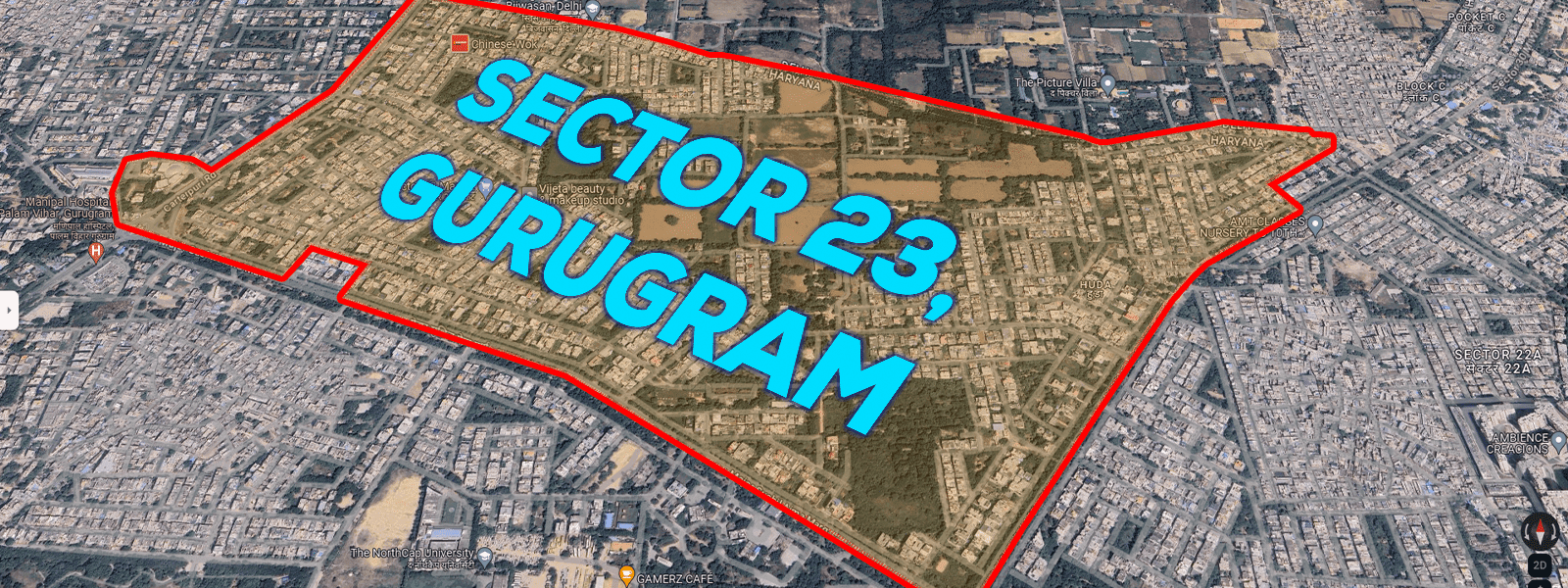

The commercial landscape of Gurgaon is diverse and layered. Cyber City, Golf Course Road, Sohna Road, and emerging sectors along the Dwarka Expressway form key business zones. Each area attracts different tenant profiles. IT firms prefer high grade offices. Retail brands focus on high visibility locations. Co working spaces thrive near residential clusters. Infrastructure, corporate presence, and ease of access define the strength of each micro market. Investors must understand these patterns before committing capital.

Tip 1 – Choose Location Based on Business Activity Not Hype

Location is the single most important factor in commercial investment. However, popularity alone does not guarantee returns. Investors must study where businesses actually operate and expand. Areas with consistent corporate movement generate steady leasing demand. Proximity to established offices, residential catchments, and transport routes matters more than marketing claims. Micro location often decides footfall and occupancy. A well located smaller unit can outperform a larger property in a weaker zone.

Tip 2 – Evaluate Infrastructure and Future Connectivity

Infrastructure directly influences commercial value. Wide roads, metro connectivity, expressway access, and parking availability improve business operations. Upcoming transport projects can significantly raise demand if they genuinely enhance accessibility. Investors should verify completion timelines and government approvals. Locations near major corridors attract corporate offices, retail chains, and logistics players. Better connectivity reduces tenant turnover. It also improves resale potential. Long term investors benefit most from areas where infrastructure growth is already visible.

Tip 3 – Understand Tenant Demand and Market Segments

Commercial property is not a single market. Office spaces, retail units, co working floors, and mixed use developments attract different tenants. Office tenants seek professional environments and long lease terms. Retail brands prioritize visibility and customer flow. Co working operators look for flexible layouts and connectivity. Investors must align property type with tenant demand in the area. Mismatch between property format and local business needs leads to higher vacancy and unstable returns.

Tip 4 – Analyze Rental Yield and Exit Potential

Rental yield is a key performance indicator for commercial investment. However, it must be evaluated realistically. Higher yields often come with higher risk or weaker tenant stability. Investors should study prevailing lease rates, occupancy levels, and average holding periods. Exit potential is equally important. Properties in established business districts attract buyers even during slowdowns. A balanced strategy focuses on stable rental income with long term capital appreciation. Avoid decisions based only on short term yield promises.

Tip 5 – Prioritize Legal Clarity and Project Compliance

Legal due diligence protects capital. Commercial investments involve zoning norms, land use approvals, and development permissions. Investors must verify ownership records, municipal clearances, and occupancy certificates. Any deviation can affect leasing rights or future resale. Compliance also impacts bank financing and institutional interest. Projects with transparent documentation attract premium tenants. Legal clarity ensures smoother transactions. It reduces disputes and safeguards long term asset value in Gurgaon’s competitive property market.

Tip 6 – Assess Developer Track Record and Delivery History

Developer credibility plays a major role in commercial success. Timely delivery, construction quality, and post possession maintenance influence tenant satisfaction. Reputed developers attract corporate tenants who prefer reliable infrastructure and professional management. Investors should review past projects, occupancy levels, and client feedback. A strong track record reduces execution risk. It also improves resale confidence. Properties developed by trusted brands often retain value better during market fluctuations.

Tip 7 – Plan for Long Term Growth Rather Than Short Term Gains

Commercial real estate rewards patience. Speculative buying based on quick appreciation often leads to disappointment. Market cycles affect demand, rentals, and liquidity. Long term investors benefit from area development, infrastructure upgrades, and corporate expansion. Holding assets through growth phases builds consistent income and capital appreciation. A strategic horizon allows investors to ride market shifts. Focus on fundamentals rather than short term price movements for sustainable success.

Common Mistakes to Avoid in Commercial Property Investment

Many investors enter the market without sufficient research. Overestimating rental income is a frequent error. Ignoring location fundamentals leads to weak occupancy. Buying solely based on developer promotions increases risk. Some investors neglect legal verification or maintenance standards. Others underestimate market cycles and exit timelines. These mistakes reduce returns and increase stress. Avoiding them requires discipline, data analysis, and a clear investment strategy aligned with long term goals.

How Professional Guidance Improves Investment Decisions

Expert guidance brings market intelligence and risk assessment. Professionals understand zoning rules, rental benchmarks, and upcoming infrastructure. They identify properties that match investment goals and budget. Advisors also assist with legal verification and tenant evaluation. This reduces uncertainty and prevents costly mistakes. In a complex market like Gurgaon, informed advice improves decision quality. It helps investors navigate competition, pricing trends, and regulatory frameworks with confidence.

Gurgaon offers strong opportunities for commercial investors who plan strategically. The city continues to attract business activity across industries. However, success depends on disciplined selection, realistic expectations, and long term vision. Location, infrastructure, tenant demand, legal clarity, and developer reputation shape outcomes. Investors who follow structured evaluation build resilient portfolios. With the right approach, commercial property in Gurgaon can deliver stable income and sustained capital growth.

Frequently Asked Questions About Commercial Investment in Gurgaon

1. Why is Gurgaon considered a strong market for commercial investment?

Gurgaon has a large corporate base, modern infrastructure, and steady business expansion. These factors create consistent demand for office, retail, and mixed use spaces, supporting long term rental stability.

2. Which locations in Gurgaon are best for commercial property investment?

Areas such as Cyber City, Golf Course Road, Sohna Road, and sectors near the Dwarka Expressway attract strong tenant demand due to connectivity, business activity, and surrounding residential growth.

3. Is commercial real estate better than residential for investment in Gurgaon?

Commercial property often offers higher rental yields and longer lease terms. However, it requires careful market study, legal checks, and a longer holding approach compared to residential investments.

4. What type of commercial property performs best in Gurgaon?

Office spaces in business hubs, retail units in high footfall areas, and mixed use developments near residential clusters tend to perform well when aligned with local demand and infrastructure.

5. How important is infrastructure for commercial investment success?

Infrastructure directly affects accessibility, tenant interest, and future value. Properties near metro lines, expressways, and major roads usually enjoy better occupancy and stronger appreciation.

6. What legal checks are necessary before buying commercial property?

Buyers must verify land use approvals, title ownership, building plans, and occupancy certificates. Proper documentation ensures smooth leasing, resale, and protection from regulatory issues.

7. Does developer reputation impact commercial property returns?

Yes, projects by established developers usually offer better construction quality, timely delivery, and professional maintenance, which attract reliable tenants and support long term asset value.

8. What rental yield can investors expect in Gurgaon’s commercial market?

Rental yield varies by location, property type, and tenant quality. Prime areas often provide stable returns, while higher yields in emerging zones may carry greater vacancy and liquidity risks.

9. Is commercial property in Gurgaon suitable for long term investment?

Yes, Gurgaon’s continuous business growth and infrastructure development make it suitable for long term wealth creation, provided investors focus on strong locations and legal clarity.

10. What mistakes should be avoided in commercial real estate investment?

Common mistakes include choosing weak locations, ignoring legal verification, overestimating rental income, and focusing only on short term price gains instead of long term market fundamentals.